More about forecasting

- ARIMA and SARIMAX models with python

- Time series forecasting with machine learning

- Forecasting time series with gradient boosting: XGBoost, LightGBM and CatBoost

- Forecasting time series with XGBoost

- Global Forecasting Models: Multi-series forecasting

- Global Forecasting Models: Comparative Analysis of Single and Multi-Series Forecasting Modeling

- Probabilistic forecasting

- Forecasting with deep learning

- Forecasting energy demand with machine learning

- Forecasting web traffic with machine learning

- Intermittent demand forecasting

- Modelling time series trend with tree-based models

- Bitcoin price prediction with Python

- Stacking ensemble of machine learning models to improve forecasting

- Interpretable forecasting models

- Mitigating the Impact of Covid on Forecasting Models

- Forecasting time series with missing values

Introduction¶

A time series is a succession of chronologically ordered data spaced at equal or unequal intervals. The forecasting process consists of predicting the future value of a time series, either by modeling the series solely based on its past behavior (autoregressive) or by using other external variables.

When creating a forecaster model, historical data are used to get a mathematical representation capable of predicting future values. This idea is based on a very important assumption: the future behavior of a phenomenon can be explained from its past behavior. However, this rarely happens in reality, or at least not in its entirety. For more on this, see the following definition:

$$Forecast = pattern + unexplained\;variance$$The first term of the equation refers to everything that has a repetitive character over time (trend, seasonality, cyclical factors...). The second term represents everything that influences the response variable but is not captured (explained) by the past of the time series.

The greater the importance of the first term relative to the second, the greater the probability of success when attempting to create autoregressive forecasting models. As the second term gains weight, it becomes necessary to incorporate additional variables (if any) into the model to help explain the observed behavior.

A good study of the modeled phenomenon and the ability to recognize to what extent its behavior can be explained by its past can save a lot of unnecessary effort.

This document shows an example of how to identify situations where the autoregressive forecasting process cannot achieve useful results. As an example, an attempt to predict the daily closing price of Bitcoin using machine learning methods is made. For this purpose, Skforecast is used, a simple Python library that allows, among other things, to adapt any Scikit-learn estimator to forecasting problems.

Use Case¶

Bitcoin (₿) is a decentralized cryptocurrency that can be sent from one user to another through the bitcoin peer-to-peer network without intermediaries. Transactions are verified and recorded in a public distributed ledger called Blockchain. Bitcoins are created as a reward for a process known as mining and can be exchanged for other currencies, products, and services.

Although there may be different opinions about Bitcoin, whether as a high-risk speculative asset or, on the other hand, as a store of value, it is undeniable that it has become one of the most valuable financial assets globally. The website Infinite Market Cap shows a list of all financial assets ranked by market capitalization. Bitcoin, at the time of writing, is in the top 10. It is close to world-renowned companies such as Tesla or globally accepted safe-haven assets such as silver. The growing interest in Bitcoin, and the world of cryptocurrencies, makes it an interesting phenomenon to model.

The aim is to generate a forecasting model capable of predicting the price of Bitcoin. A time series is available with the opening (Open), closing (Close), maximum (High), and minimum (Low) prices of Bitcoin in US dollars (USD) from 2013-04-28 to 2022-01-01.

Libraries¶

The libraries used in this document are:

# Data manipulation

# ==============================================================================

import pandas as pd

import numpy as np

import datetime

# Plots

# ==============================================================================

import matplotlib.pyplot as plt

import plotly.graph_objects as go

import plotly.express as px

import seaborn as sns

from statsmodels.graphics.tsaplots import plot_acf

from statsmodels.graphics.tsaplots import plot_pacf

from skforecast.plot import set_dark_theme

# Modelling and Forecasting

# ==============================================================================

import skforecast

import sklearn

import lightgbm

from skforecast.recursive import ForecasterRecursive

from skforecast.model_selection import TimeSeriesFold

from skforecast.model_selection import backtesting_forecaster

from lightgbm import LGBMRegressor

from sklearn.metrics import mean_absolute_error

# warnings

# ==============================================================================

import warnings

from skforecast.exceptions import LongTrainingWarning

warnings.filterwarnings("once")

warnings.simplefilter('ignore', category=LongTrainingWarning)

color = "\033[1m\033[38;5;208m"

print(f"{color}Version skforecast: {skforecast.__version__}")

print(f"{color}Version scikit-learn: {sklearn.__version__}")

print(f"{color}Version lightgbm: {lightgbm.__version__}")

print(f"{color}Version pandas: {pd.__version__}")

print(f"{color}Version numpy: {np.__version__}")

Version skforecast: 0.19.0 Version scikit-learn: 1.7.2 Version lightgbm: 4.6.0 Version pandas: 2.3.3 Version numpy: 2.3.4

Data¶

Data used in this document are daily records of the Bitcoin price in USD from 2013-04-28 to 2022-01-01. The dataset contains the following columns:

Date: date of the record.Open: the opening price, the price at which an asset, in this case, Bitcoin, trades at the beginning of the day. (USD).High: the maximum price of the day, the highest price reached by Bitcoin on that day, (USD).Low: the minimum price of the day, the lowest price reached by the Bitcoin on that day, (USD).Close: the closing price, the price at which Bitcoin trades at the end of the day, (USD).Volume: the sum of actual trades made during the day, (USD).Market Cap: market capitalization, the total value of all shares of a company or, in the case of Bitcoin or another cryptocurrency, of all coins in circulation, (USD).

Note: the cryptocurrency market is uninterrupted. It operates 24 hours a day, 7 days a week. However, it is not strictly necessary that the close price coincides with the open price of the next day because of the fluctuations that the value of Bitcoin, or any cryptocurrency, may undergo during the last second of the day.

# Data download

# ==============================================================================

data = pd.read_csv(

"https://raw.githubusercontent.com/skforecast/skforecast-datasets/main/data/bitcoin.csv"

)

data['date'] = pd.to_datetime(data['date'])

data = data.set_index('date')

data = data.asfreq('D')

data

| open | high | low | close | volume | market cap | |

|---|---|---|---|---|---|---|

| date | ||||||

| 2013-04-28 | 128.000100 | 128.000100 | 128.000100 | 128.000100 | 0.000000e+00 | 1.418304e+09 |

| 2013-04-29 | 134.444400 | 135.980000 | 132.100000 | 134.210000 | 0.000000e+00 | 1.488338e+09 |

| 2013-04-30 | 134.444000 | 147.488000 | 134.000000 | 144.540000 | 0.000000e+00 | 1.549501e+09 |

| 2013-05-01 | 144.000000 | 146.930000 | 134.050000 | 139.000000 | 0.000000e+00 | 1.578685e+09 |

| 2013-05-02 | 139.000000 | 139.890000 | 107.720000 | 116.990000 | 0.000000e+00 | 1.422546e+09 |

| ... | ... | ... | ... | ... | ... | ... |

| 2021-12-28 | 50787.263830 | 51950.912600 | 50459.263641 | 50650.171445 | 4.695844e+10 | 9.655866e+11 |

| 2021-12-29 | 50667.988338 | 50667.988338 | 47411.717237 | 47637.888400 | 5.939821e+10 | 9.241336e+11 |

| 2021-12-30 | 47547.865500 | 48112.021472 | 46272.662981 | 46408.302671 | 8.826973e+10 | 8.998872e+11 |

| 2021-12-31 | 46430.481224 | 47876.491839 | 46077.722276 | 47161.009200 | 1.229248e+11 | 8.907742e+11 |

| 2022-01-01 | 47139.359000 | 48505.999700 | 45712.566592 | 46304.949594 | 7.810027e+10 | 8.945653e+11 |

3171 rows × 6 columns

When setting a frequency with the asfreq() method, Pandas fills the gaps that may exist in the time series with the value of Null to ensure the indicated frequency. Therefore, it should be checked if missing values have appeared after this transformation.

print(f'Number of rows with missing values: {data.isnull().any(axis=1).mean()}')

Number of rows with missing values: 0.0

Bitcoin halving as an exogenous variable¶

Halving is a programmed event and is part of the design and operation of some cryptocurrencies. The miners validate the transaction blocks of the network, in this case, Bitcoin, and each time they succeed, they receive an amount of that digital currency. This amount varies from time to time.

Every time 210,000 blocks are added, the reward in the Bitcoin blockchain change occurs. This event, called halving, occurs approximately every 4 years and reduces the coins miners receive as a reward by half.

In the history of Bitcoin, there have been 3 halvings. When Bitcoin mining started, miners received 50 BTC for successfully mining a block. In 2012, it reduced this reward to 25 BTC; in 2016, it dropped to 12.5 BTC, and in 2020 to 6.25 BTC, after the third halving. Each halving has affected the price, although it has not been in the short term after it.

It is intended to use the days remaining until the next halving and its mining rewards as exogenous variables to predict the price of Bitcoin. The next halving is estimated to occur approximately in 2024, although its exact date is unknown. The remaining blocks as of 2022-01-14 from the Coinmarketcap website, 121,400, and the average number of Bitcoin network blocks mined per day, 144 (average block time ≈ 10 minutes) are used to determine it.

Note: when incorporating predicted data as an exogenous variable, their error is introduced in the forecasting model since they are predictions.

# Dict with Bitcoin halvings info

# ==============================================================================

btc_halving = {

"halving": [0, 1, 2, 3, 4],

"date": ["2009-01-03", "2012-11-28", "2016-07-09", "2020-05-11", np.nan],

"reward": [50, 25, 12.5, 6.25, 3.125],

"halving_block_number": [0, 210000, 420000, 630000, 840000],

}

# Next halving calculation

# The remaining blocks according to the coinmarketcap.com website for

# the next halving as of 2022-01-14 are taken as a starting point

# ==============================================================================

remaining_blocks = 121400

blocks_per_day = 144

days = remaining_blocks / blocks_per_day

next_halving = pd.to_datetime('2022-01-14', format='%Y-%m-%d') + datetime.timedelta(days=days)

next_halving = next_halving.replace(microsecond=0, second=0, minute=0, hour=0)

next_halving = next_halving.strftime('%Y-%m-%d')

btc_halving['date'][-1] = next_halving

print(f'The next halving will occur on approximately: {next_halving}')

The next halving will occur on approximately: 2024-05-06

# Include rewards and countdown to next halving in dataset

# ==============================================================================

data["reward"] = np.nan

data["countdown_halving"] = np.nan

for i in range(len(btc_halving["halving"]) - 1):

# Start and end date of each halving

if btc_halving["date"][i] < data.index.min().strftime("%Y-%m-%d"):

start_date = data.index.min().strftime("%Y-%m-%d")

else:

start_date = btc_halving["date"][i]

end_date = btc_halving["date"][i + 1]

mask = (data.index >= start_date) & (data.index < end_date)

# Fill column 'reward' with mining rewards

data.loc[mask, "reward"] = btc_halving["reward"][i]

# Fill column 'countdown_halving' with remaining days

time_to_next_halving = pd.to_datetime(end_date) - pd.to_datetime(start_date)

data.loc[mask, "countdown_halving"] = np.arange(time_to_next_halving.days)[::-1][

: mask.sum()

]

# Check that the data have been created correctly

# ==============================================================================

print("Second halving:", btc_halving["date"][2])

display(data.loc["2016-07-08":"2016-07-09"])

print("")

print("Third halving:", btc_halving["date"][3])

display(data.loc["2020-05-10":"2020-05-11"])

print("")

print("Next halving:", btc_halving["date"][4])

data.tail(2)

Second halving: 2016-07-09

| open | high | low | close | volume | market cap | reward | countdown_halving | |

|---|---|---|---|---|---|---|---|---|

| date | ||||||||

| 2016-07-08 | 677.331 | 682.432 | 611.834 | 639.667 | 1.892361e+08 | 1.015055e+10 | 25.0 | 0.0 |

| 2016-07-09 | 640.562 | 666.707 | 636.467 | 666.707 | 2.061508e+08 | 1.020561e+10 | 12.5 | 1401.0 |

Third halving: 2020-05-11

| open | high | low | close | volume | market cap | reward | countdown_halving | |

|---|---|---|---|---|---|---|---|---|

| date | ||||||||

| 2020-05-10 | 9814.400817 | 9900.431521 | 9559.705894 | 9570.005988 | 3.675906e+10 | 1.786858e+11 | 12.50 | 0.0 |

| 2020-05-11 | 9554.216377 | 9554.216377 | 8388.959555 | 8745.152545 | 4.909643e+10 | 1.598261e+11 | 6.25 | 1455.0 |

Next halving: 2024-05-06

| open | high | low | close | volume | market cap | reward | countdown_halving | |

|---|---|---|---|---|---|---|---|---|

| date | ||||||||

| 2021-12-31 | 46430.481224 | 47876.491839 | 46077.722276 | 47161.009200 | 1.229248e+11 | 8.907742e+11 | 6.25 | 856.0 |

| 2022-01-01 | 47139.359000 | 48505.999700 | 45712.566592 | 46304.949594 | 7.810027e+10 | 8.945653e+11 | 6.25 | 855.0 |

Graphic exploration¶

When it is necessary to generate a forecasting model, plotting the time series values could be useful. This allows identifying patterns such as trends and seasonality.

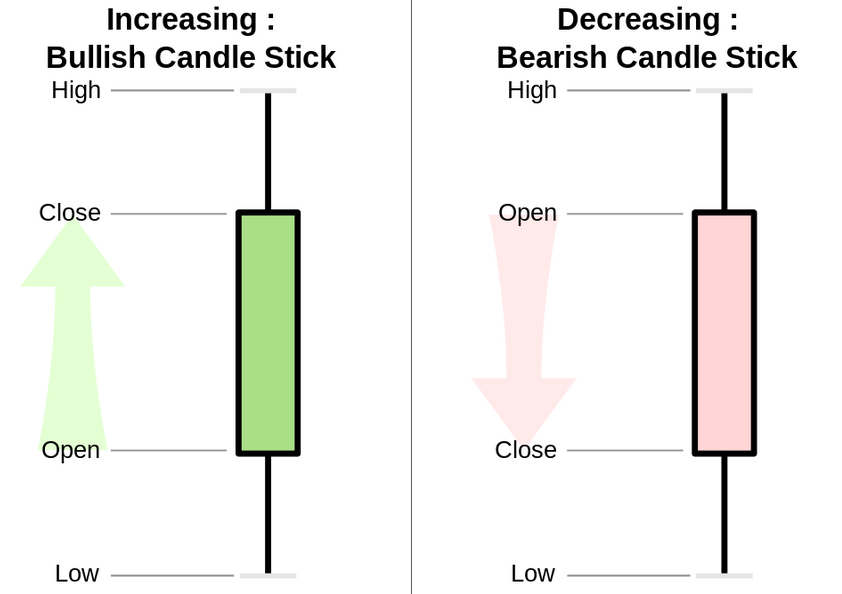

Candlestick chart¶

A candlestick chart is a style of financial chart used to describe price movements of a security, derivative, or currency. The thick body shows the variation between the opening and closing price for a period, while the shadows show the minimum and maximum values reached during that period.

# Interactive candlestick chart with Plotly

# ==============================================================================

candlestick = go.Candlestick(

x=data.index,

open=data.open,

close=data.close,

low=data.low,

high=data.high,

)

fig = go.Figure(data=[candlestick])

fig.update_layout(

width=750,

height=350,

title=dict(text="<b>Bitcoin/USD Chart</b>", font=dict(size=20)),

yaxis_title=dict(text="Price (USD)", font=dict(size=15)),

margin=dict(l=10, r=20, t=80, b=20),

shapes=[

dict(

x0=btc_halving["date"][2],

x1=btc_halving["date"][2],

y0=0,

y1=1,

xref="x",

yref="paper",

line_width=2,

),

dict(

x0=btc_halving["date"][3],

x1=btc_halving["date"][3],

y0=0,

y1=1,

xref="x",

yref="paper",

line_width=2,

),

dict(

x0=btc_halving["date"][4],

x1=btc_halving["date"][4],

y0=0,

y1=1,

xref="x",

yref="paper",

line_width=2,

),

],

annotations=[

dict(

x=btc_halving["date"][2],

y=1,

xref="x",

yref="paper",

showarrow=False,

xanchor="left",

text="Second halving",

),

dict(

x=btc_halving["date"][3],

y=1,

xref="x",

yref="paper",

showarrow=False,

xanchor="left",

text="Third halving",

),

dict(

x=btc_halving["date"][4],

y=1,

xref="x",

yref="paper",

showarrow=False,

xanchor="left",

text="Fourth halving",

),

],

xaxis_rangeslider_visible=False,

)

fig.show()

Data distribution¶

The distribution of the Bitcoin closing price, variable close, is shown.

# KDE distribution of Bitcoin closing price

# ==============================================================================

set_dark_theme()

fig, ax = plt.subplots(figsize=(6, 3))

p = sns.kdeplot(data=data, x='close', linewidth=3, ax=ax)

r = sns.rugplot(data=data, x='close', ax=ax, height=-.03, clip_on=False)

p.set(xlim=(0, None))

p.set_title('KDE Bitcoin closing price', fontsize=15)

p.set_xlabel('Price (USD)');

The study data shows a majority distribution of prices below 20,000 (USD). This stage corresponds to the period between 2013 and September 2020. Since 2021, the price has been in the range of 35,000 - 67,500 (USD).

Trying to model a time series with a highly asymmetric distribution and distinct orders of magnitude over time can cause complications. One strategy is model changes (deltas) rather than direct values to minimize these problems. It could be further simplified, indicating only whether the price increases or decreases from the previous day.

Note: when a distribution is asymmetric, modeling deltas instead of price may result in a more symmetric distribution.

Price per year¶

# Locate corresponding data for each year

# ==============================================================================

years = list(data.index.year.unique())

df_plot = pd.DataFrame()

for year in years:

year_open = data.loc[data.index.year == year, "open"].iloc[0]

year_close = data.loc[data.index.year == year, "close"].iloc[-1]

year_low = data.loc[data.index.year == year, "low"].min()

year_high = data.loc[data.index.year == year, "high"].max()

df_plot[year] = pd.Series([year_open, year_close, year_low, year_high])

df_plot = df_plot.T

df_plot = df_plot.set_axis(["open", "close", "low", "high"], axis=1)

# Calculate % change between the open and close price of the year

# ==============================================================================

df_plot["year_change"] = 100 * (df_plot["close"] - df_plot["open"]) / df_plot["open"]

df_plot.head(3)

| open | close | low | high | year_change | |

|---|---|---|---|---|---|

| 2013 | 128.0001 | 756.130 | 65.526 | 1156.140 | 490.726101 |

| 2014 | 760.3200 | 310.610 | 289.296 | 1017.120 | -59.147464 |

| 2015 | 310.7370 | 426.371 | 171.510 | 495.562 | 37.212820 |

# Create a list of dicts with the % change annotations for the plot

# ==============================================================================

annotations_list = []

max_high = df_plot["high"].max()

for year in years:

df_aux = df_plot.loc[df_plot.index == year,]

loc_x = pd.to_datetime(df_aux.index[0], format="%Y")

loc_y = df_aux["high"].values[0] / max_high + 0.05

text = "{:.1f}%".format(df_aux["year_change"].values[0])

annotation = dict(

x=loc_x,

y=loc_y,

xref="x",

yref="paper",

showarrow=False,

xanchor="center",

text=text,

)

annotations_list.append(annotation)

# Interactive candlestick chart with Plotly

# ==============================================================================

candlestick = go.Candlestick(

x=pd.to_datetime(df_plot.index, format="%Y"),

open=df_plot.open,

close=df_plot.close,

low=df_plot.low,

high=df_plot.high,

)

fig = go.Figure(data=[candlestick])

fig.update_layout(

width=750,

height=350,

title=dict(text="<b>Bitcoin/USD yearly chart</b>", font=dict(size=20)),

yaxis_title=dict(text="Price (USD)", font=dict(size=13)),

margin=dict(l=0, r=20, t=55, b=20),

xaxis_rangeslider_visible=False,

annotations=annotations_list,

)

fig.show()

Annual, monthly and weekly seasonality¶

# Locate corresponding data for each month

# ==============================================================================

years = list(data.index.year.unique())

df_plot = pd.DataFrame()

for year in years:

for month in range(12):

start_date = pd.to_datetime(f"{year}-{month+1}-01", format="%Y-%m-%d")

end_date = start_date + pd.offsets.MonthBegin()

mask = (data.index >= start_date) & (data.index < end_date)

if not data.loc[mask, :].empty:

month_open = data.loc[mask, "open"].iloc[0]

month_close = data.loc[mask, "close"].iloc[-1]

month_low = data.loc[mask, "low"].min()

month_high = data.loc[mask, "high"].max()

serie = pd.Series([month_open, month_close, month_low, month_high])

df_aux = pd.DataFrame(serie, columns=[f"{str(month+1).zfill(2)}-{year}"])

if df_plot.empty:

df_plot = df_aux.copy()

else:

df_plot = pd.concat([df_plot, df_aux], axis=1)

df_plot = df_plot.T

df_plot = df_plot.set_axis(["open", "close", "low", "high"], axis=1)

# Boxplot chart for annual seasonality

# ==============================================================================

df_plot["month"] = pd.to_datetime(df_plot.index, format="%m-%Y").month

# fig 1 monthly boxplot

fig1 = px.box(

df_plot.sort_values("month"),

x="month",

y="close",

)

# fig 2 line with median data for each month

df_median = pd.DataFrame(df_plot.groupby("month")["close"].median()).reset_index()

fig2 = px.line(

df_median,

x="month",

y="close",

markers=True,

)

fig = go.Figure(data=fig1.data + fig2.data)

fig.update_layout(

width=650,

height=350,

title=dict(text="<b>BTC Price per month</b>", font=dict(size=20)),

yaxis_title=dict(text="Price (USD)", font=dict(size=13)),

xaxis=dict(tickmode="linear"),

xaxis_title=dict(text="month", font=dict(size=13)),

margin=dict(l=0, r=20, t=55, b=20),

)

fig.show()

# Boxplot chart for monthly seasonality

# ==============================================================================

data["day"] = pd.Series(data.index).dt.day.values

# fig 1 dayly boxplot

fig1 = px.box(data.sort_values("day"), x="day", y="close")

# fig 2 line with median data for each day

df_median = pd.DataFrame(data.groupby("day")["close"].median()).reset_index()

fig2 = px.line(df_median, x="day", y="close", markers=True)

fig = go.Figure(data=fig1.data + fig2.data)

fig.update_layout(

width=750,

height=350,

title=dict(text="<b>BTC Price per day of the month</b>", font=dict(size=20)),

yaxis_title=dict(text="Price (USD)", font=dict(size=13)),

xaxis=dict(tickmode="linear", tickangle=0, range=[0.5, 31.5]),

xaxis_title=dict(text="day", font=dict(size=13)),

margin=dict(l=0, r=20, t=55, b=20),

)

fig.show()

# Boxplot chart for weekly seasonality

# ==============================================================================

data["weekday"] = data.index.day_of_week + 1

# fig 1 weekly boxplot

fig1 = px.box(data.sort_values("weekday"), x="weekday", y="close")

# fig 2 line with median data for each weekday

df_median = pd.DataFrame(data.groupby("weekday")["close"].median()).reset_index()

fig2 = px.line(df_median, x="weekday", y="close", markers=True)

fig = go.Figure(data=fig1.data + fig2.data)

fig.update_layout(

width=600,

height=300,

title=dict(text="<b>BTC Price per day of the week</b>", font=dict(size=20)),

yaxis_title=dict(text="Price (USD)", font=dict(size=13)),

xaxis=dict(tickmode="linear"),

xaxis_title=dict(text="weekday", font=dict(size=13)),

margin=dict(l=0, r=20, t=55, b=20),

)

fig.show()

Usually, time series with an autoregressive pattern produce a repetitive shape (trend, seasonality, cyclical factors). Regarding Bitcoin, a certain annual seasonality appears at the end and beginning of the year, with larger variations in price. No seasonality appears in the monthly and weekly intervals, with very similar distributions.

Autocorrelation plots¶

# Autocorrelation plots

# ==============================================================================

fig, axes = plt.subplots(nrows=1, ncols=2, figsize=(10, 4))

axes = axes.flat

plot_acf(data.close, ax=axes[0], linewidth = 1, lags=100)

axes[0].set_ylim(-1.1, 1.1)

plot_pacf(data.close, ax=axes[1], lags=20, method='ywm', linewidth = 1)

axes[1].set_ylim(-1.1, 1.1)

plt.show();

The autocorrelation plots show that lag 1 is the only one correlated with lag 0. The following lags do not exceed the significance threshold.

Baseline - Random walk simulation¶

When generating a predictive model, it is convenient to identify a base model, or baseline, on which to compare each of the proposed iterations or models. In the case of finance, according to random walk theory, market prices behave randomly and not as a function of their time series. Thus, the best estimate of the value $t_{n+1}$ is the value $t_{n}$ plus an unpredictable change.

Although a broad time series is available, it presents periods with highly differentiated prices, as determined in the graphical exploration. Only data from the last two years are used.

# Selection of train-test dates

# ==============================================================================

start_train = '2020-01-01 00:00:00'

end_train = '2021-06-30 23:59:59'

print(f"Complete time series : {data.index.min()} --- {data.index.max()} (n={len(data)})")

print(f"Train dates : {data.loc[start_train:end_train].index.min()} --- {data.loc[start_train:end_train].index.max()} (n={len(data.loc[start_train:end_train])})")

print(f"Test dates : {data.loc[end_train:].index.min()} --- {data.loc[end_train:].index.max()} (n={len(data.loc[end_train:])})")

Complete time series : 2013-04-28 00:00:00 --- 2022-01-01 00:00:00 (n=3171) Train dates : 2020-01-01 00:00:00 --- 2021-06-30 00:00:00 (n=547) Test dates : 2021-07-01 00:00:00 --- 2022-01-01 00:00:00 (n=185)

As mentioned above, random walk suggests that the best estimate for the $t_{n+1}$ value is the $t_{n}$ value plus an unpredictable change. Therefore, the simplest viable model uses the value of $t_{n}$ as the prediction for the $t_{n+1}$ value. It is set as the baseline model.

# Random walk simulation

# ==============================================================================

df_rw = data[['close']].copy()

df_rw['pred_close'] = df_rw['close'].shift(1)

# Test error

# ==============================================================================

y_true = df_rw.loc[end_train:, 'close']

y_pred = df_rw.loc[end_train:, 'pred_close']

metric = mean_absolute_error(y_true, y_pred)

print(f'Test error: {metric}')

display(df_rw.loc[end_train:,].head(4))

Test error: 1260.3677521425916

| close | pred_close | |

|---|---|---|

| date | ||

| 2021-07-01 | 35060.428966 | 35840.386468 |

| 2021-07-02 | 33628.670000 | 35060.428966 |

| 2021-07-03 | 33846.007087 | 33628.670000 |

| 2021-07-04 | 34698.303129 | 33846.007087 |

# Plot

# ==============================================================================

fig, ax = plt.subplots(figsize=(8, 4))

df_rw.loc[end_train:, 'close'].plot(ax=ax, linewidth=2, label='Test')

df_rw.loc[end_train:, 'pred_close'].plot(ax=ax, linewidth=2, label='Prediction')

ax.set_title('Random Walk (Test data)')

ax.set_ylabel('Price (USD)')

ax.legend();

# DataFrame models' test error

# ==============================================================================

df_errors = pd.DataFrame({

'model': 'Base - Random Walk',

'lags': 1,

'test_error': metric,

'exog_variables': False

},

index=[0]

)

df_errors

| model | lags | test_error | exog_variables | |

|---|---|---|---|---|

| 0 | Base - Random Walk | 1 | 1260.367752 | False |

The model test error is 1260.37. The following sections intend to generate a model capable of reducing this error.

Recursive autoregressive forecaster¶

An Autoregressive Forecaster (ForecasterRecursive) with a LightGBM estimator, an implementation of the Gradient Boosting algorithm developed by Microsoft that usually achieves excellent results, is used to model the Bitcoin price.

Previous sections show an absence of autocorrelation beyond the first lag. One way to verify this is to train several models with an increasing amount of lags and check if the error doesn't reduce. This approach can be done by backtesting, using steps = 1 (predict only the next value in the series, $t_{n+1}$) it reproduces the random walk model methodology.

# Forecasters backtest with different lags

# ==============================================================================

lags = [1, 7, 30]

metrics = []

predictions_list = []

for lag in lags:

# Create forecaster

forecaster = ForecasterRecursive(

estimator = LGBMRegressor(random_state=123, verbose=-1),

lags = lag,

transformer_y = None

)

# Backtest test data, 1 step

cv = TimeSeriesFold(

steps = 1,

initial_train_size = len(data.loc[start_train:end_train, 'close']),

fixed_train_size = True,

refit = True,

)

metric, predictions = backtesting_forecaster(

forecaster = forecaster,

y = data.loc[start_train:, 'close'],

cv = cv,

metric = 'mean_absolute_error',

verbose = False,

show_progress = True,

)

metrics.append(metric.at[0, 'mean_absolute_error'])

predictions_list.append(predictions)

# Plot

# ==============================================================================

fig, ax = plt.subplots(figsize=(8, 4))

data.loc[end_train:, 'close'].plot(ax=ax, linewidth=2, label='Test')

# Plot test predictions for different lags

for predictions, lag in zip(predictions_list, lags):

predictions = predictions.rename(columns={'pred': f'Prediction, {lag} lags'})

predictions[f'Prediction, {lag} lags'].plot(ax=ax)

ax.set_title('Close Price vs Predictions (Test Data)')

ax.set_ylabel('Price (USD)')

ax.legend();

# DataFrame models' test error

# ==============================================================================

model = 'LGBMRegressor'

df_errors = pd.concat([

df_errors,

pd.DataFrame({

'model': model,

'lags': lags,

'test_error': metrics,

'exog_variables': False

})

]).reset_index(drop=True)

df_errors.sort_values(by='test_error')

| model | lags | test_error | exog_variables | |

|---|---|---|---|---|

| 0 | Base - Random Walk | 1 | 1260.367752 | False |

| 1 | LGBMRegressor | 1 | 1527.440787 | False |

| 2 | LGBMRegressor | 7 | 1546.268058 | False |

| 3 | LGBMRegressor | 30 | 1561.058347 | False |

The test errors (which reflect how well each model generalizes) show that none of the models improves the baseline despite incorporating more information from the past (number of lags). Because of the results, other alternatives are tested, such as incorporating exogenous variables into the series.

Forecasting with exogenous variables¶

In the previous example, only lags of the predicted variable itself have been used as predictors. In some scenarios, it is possible to have information about other variables, whose future value is known, and which can serve as additional predictors in the model. Typical examples are:

Holidays (local, national...)

Month of the year

Day of the week

Time of day

For this case, it is used the variables resulting from the section about Bitcoin halving and, after studying seasonality, the month of the year.

Note: The reward and month variables, although encoded as numbers, are categorical, so it is convenient to change the type with which they are stored. Since these variables do not have many levels, the One Hot Encoding transformation is used to incorporate them into the model.

# One hot encoding categorical variables

# ==============================================================================

data['month'] = data.index.month

data = pd.get_dummies(data, columns=['reward', 'month'], dtype=int)

data.head(2)

| open | high | low | close | volume | market cap | countdown_halving | day | weekday | reward_6.25 | ... | month_3 | month_4 | month_5 | month_6 | month_7 | month_8 | month_9 | month_10 | month_11 | month_12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 2013-04-28 | 128.0001 | 128.0001 | 128.0001 | 128.0001 | 0.0 | 1.418304e+09 | 1167.0 | 28 | 7 | 0 | ... | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2013-04-29 | 134.4444 | 135.9800 | 132.1000 | 134.2100 | 0.0 | 1.488338e+09 | 1166.0 | 29 | 1 | 0 | ... | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

2 rows × 24 columns

# All exogenous variables are selected, including those obtained

# during one hot encoding.

# ==============================================================================

exog = [column for column in data.columns if column.startswith(('reward', 'month'))]

exog.extend(['countdown_halving'])

exog

['reward_6.25', 'reward_12.5', 'reward_25.0', 'month_1', 'month_2', 'month_3', 'month_4', 'month_5', 'month_6', 'month_7', 'month_8', 'month_9', 'month_10', 'month_11', 'month_12', 'countdown_halving']

# Forecaster backtest with exogenous variables

# ==============================================================================

forecaster = ForecasterRecursive(

estimator = LGBMRegressor(random_state=123, verbose=-1),

lags = 1,

transformer_y = None,

transformer_exog = None

)

# Backtest test data, 1 step

metric, predictions = backtesting_forecaster(

forecaster = forecaster,

y = data.loc[start_train:, 'close'],

exog = data.loc[start_train:, exog],

cv = cv,

metric = 'mean_absolute_error',

verbose = False,

show_progress = True

)

# Plot

# ==============================================================================

fig, ax = plt.subplots(figsize=(8, 4))

data.loc[end_train:, 'close'].plot(ax=ax, linewidth=2, label='Test')

# Plot predictions 1 lag without exogenous variables

predictions_no_exog = predictions_list[0].rename(columns={'pred': 'Predictions, 1 lag'})

predictions_no_exog['Predictions, 1 lag'].plot(ax=ax)

# Plot predictions 1 lag with exogenous variables

predictions_exog = predictions.rename(columns={'pred': 'Predictions, 1 lag with exog'})

predictions_exog['Predictions, 1 lag with exog'].plot(ax=ax)

ax.set_title('Close Price vs Predictions (Test Data)')

ax.set_ylabel('Price (USD)')

ax.legend();

# DataFrame models' test error

# ==============================================================================

model = 'LGBMRegressor'

df_errors = pd.concat([

df_errors,

pd.DataFrame({

'model': model,

'lags': lags,

'test_error': metrics,

'exog_variables': True

})

]).reset_index(drop=True)

df_errors.sort_values(by='test_error')

| model | lags | test_error | exog_variables | |

|---|---|---|---|---|

| 0 | Base - Random Walk | 1 | 1260.367752 | False |

| 1 | LGBMRegressor | 1 | 1527.440787 | False |

| 4 | LGBMRegressor | 1 | 1527.440787 | True |

| 2 | LGBMRegressor | 7 | 1546.268058 | False |

| 5 | LGBMRegressor | 7 | 1546.268058 | True |

| 3 | LGBMRegressor | 30 | 1561.058347 | False |

| 6 | LGBMRegressor | 30 | 1561.058347 | True |

Even incorporating exogenous variables, the model does not improve the baseline (random walk).

Conclusions¶

Bitcoin price does not follow an autoregressive pattern. The best estimate for the $t_{n+1}$ value is the $t_{n}$ value plus an unpredictable change. Early identification of the absence of this correlation by descriptive analysis avoids unnecessary modeling efforts.

When a time series with no autocorrelation is available, one should look for exogenous variables capable of helping with the problem. For example, to predict the price of Bitcoin in the short term (hours), exogenous variables such as the market sentiment through the analysis of tweets, impact of the so-called key opinion leaders, analysis of the most relevant news, etc. could be used.

Using machine learning models in forecasting problems is very simple thanks to the functionalities offered by Skforecast.

Session information¶

import session_info

session_info.show(html=False)

----- lightgbm 4.6.0 matplotlib 3.10.8 numpy 2.3.4 pandas 2.3.3 plotly 6.4.0 seaborn 0.13.2 session_info v1.0.1 skforecast 0.19.0 sklearn 1.7.2 statsmodels 0.14.5 ----- IPython 9.7.0 jupyter_client 8.6.3 jupyter_core 5.9.1 ----- Python 3.13.9 | packaged by conda-forge | (main, Oct 22 2025, 23:12:41) [MSC v.1944 64 bit (AMD64)] Windows-11-10.0.26100-SP0 ----- Session information updated at 2025-11-28 21:15

Citation¶

How to cite this document

If you use this document or any part of it, please acknowledge the source, thank you!

Bitcoin price prediction with Python, when the past does not repeat itself by Joaquín Amat Rodrigo and Javier Escobar Ortiz, available under a Attribution 4.0 International (CC BY 4.0) at https://www.cienciadedatos.net/documentos/py41-forecasting-cryptocurrency-bitcoin-machine-learning-python.html

How to cite skforecast

If you use skforecast for a publication, we would appreciate it if you cite the published software.

Zenodo:

Amat Rodrigo, Joaquin, & Escobar Ortiz, Javier. (2024). skforecast (v0.19.0). Zenodo. https://doi.org/10.5281/zenodo.8382788

APA:

Amat Rodrigo, J., & Escobar Ortiz, J. (2024). skforecast (Version 0.19.0) [Computer software]. https://doi.org/10.5281/zenodo.8382788

BibTeX:

@software{skforecast, author = {Amat Rodrigo, Joaquin and Escobar Ortiz, Javier}, title = {skforecast}, version = {0.19.0}, month = {11}, year = {2025}, license = {BSD-3-Clause}, url = {https://skforecast.org/}, doi = {10.5281/zenodo.8382788} }

Did you like the article? Your support is important

Your contribution will help me to continue generating free educational content. Many thanks! 😊

This work by Joaquín Amat Rodrigo and Javier Escobar Ortiz is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International.

Allowed:

-

Share: copy and redistribute the material in any medium or format.

-

Adapt: remix, transform, and build upon the material.

Under the following terms:

-

Attribution: You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

-

NonCommercial: You may not use the material for commercial purposes.

-

ShareAlike: If you remix, transform, or build upon the material, you must distribute your contributions under the same license as the original.